Build an AI-Powered Investment Strategy with ForecastOS: Live Demo

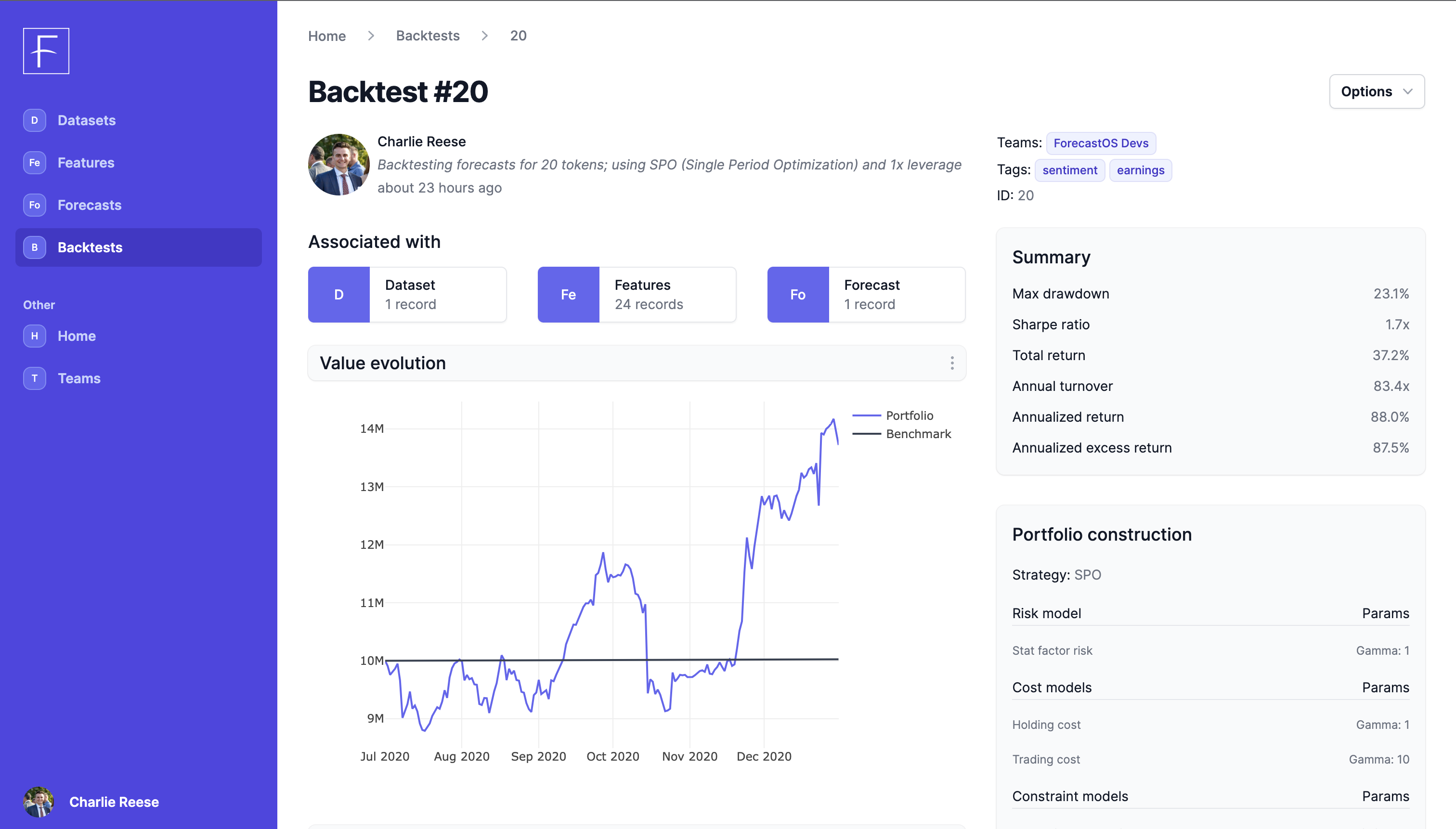

In a ~13 minute video, we build and backtest an ML-powered market and factor neutral quantitative investment strategy using ForecastOS and InvestOS.

Pre-engineered features / factors for forecasts and analysis.

OS portfolio engineering and risk software.

Investment system of record.

Financial datasets.

In a ~13 minute video, we build and backtest an ML-powered market and factor neutral quantitative investment strategy using ForecastOS and InvestOS.

With our software, tools, and expertise, this exercise could be repeated to tailor any institutional investment strategy to any unique client mandate or market demand.

When a U.S. hedge fund asked us to help with research to dampen volatility from shifting tariff rhetoric in the Trump era, the first road-block was obvious: no comprehensive dataset captured which of the most active ~3,000 U.S. equities were truly exposed to tariffs, let alone gave the knobs to dial those exposures up or down.

Eliminate 80% of data science work with ForecastOS FeatureHub! For quantitative investors, researchers, and data scientists. Pull pre-engineered feature / factor data from anywhere in 1 line of code; no data engineering pipeline required.

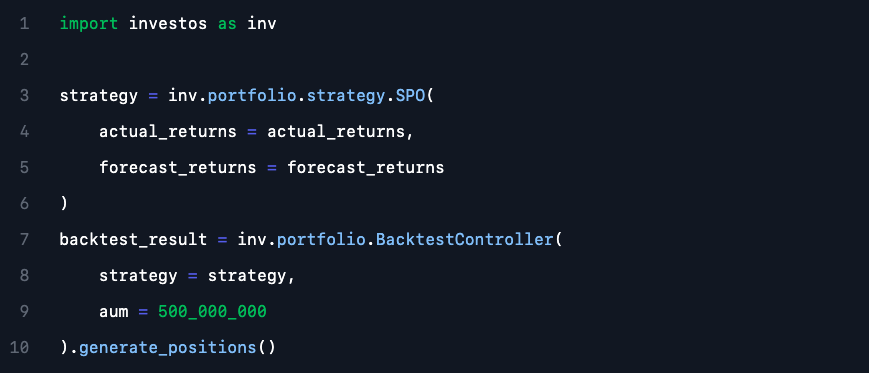

Open-source portfolio engineering / optimization, backtesting, risk models, and reporting software. Enterprise support available by request.

View Guides

Visualize, manage, understand, and analyze your systematic investment research processes in a friendly UI with enterprise-grade access management.

Custom data, software, and intelligence solutions. Previous projects include valuing / pricing a financial dataset, custom portfolio engineering, and hosting a backtesting API.

Book a no-pressure call to explore our solutions. If it's a fit, we'll plan and walk you through a simple setup process.