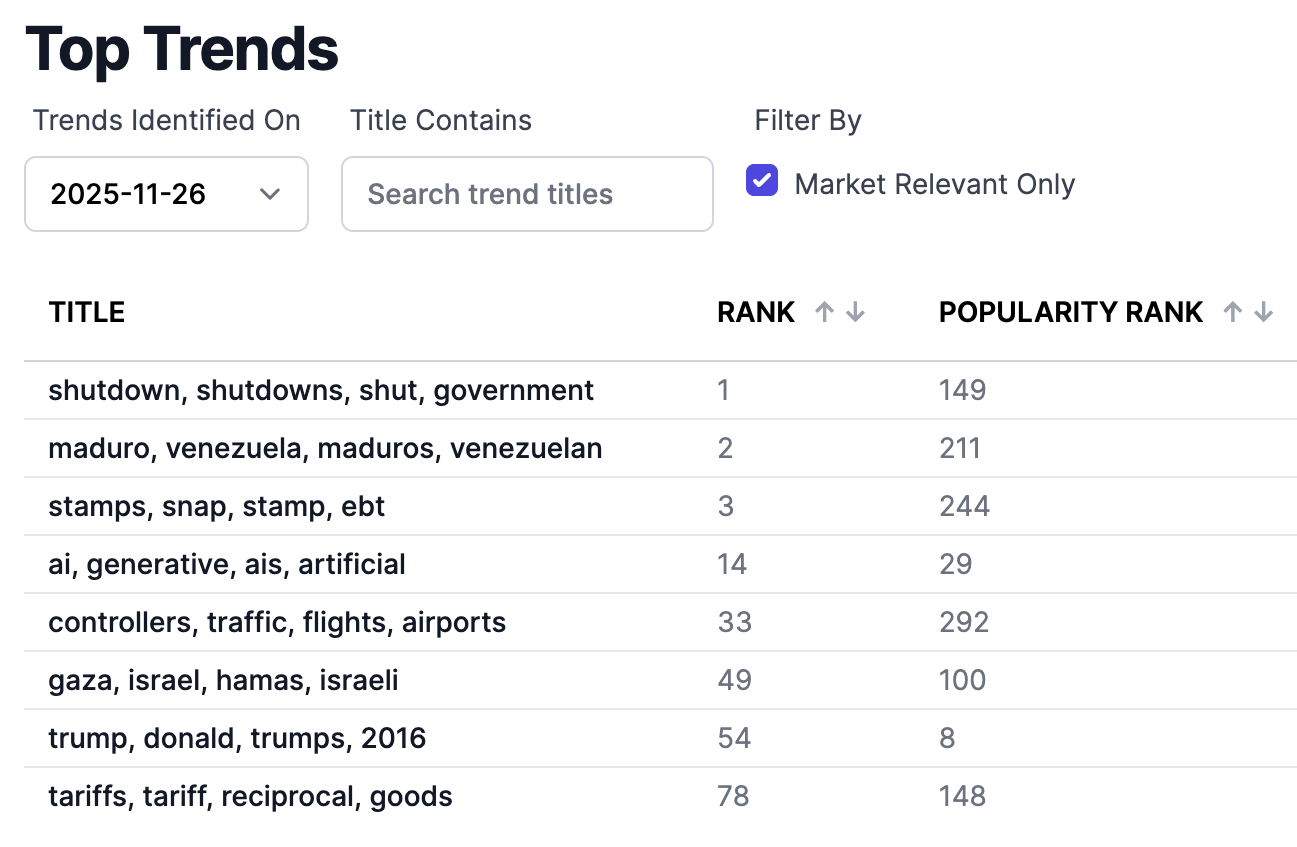

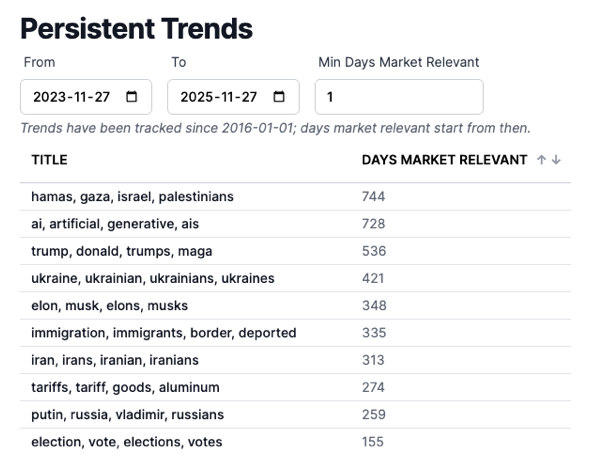

From Narratives to Numbers: Measuring Belief with Hivemind

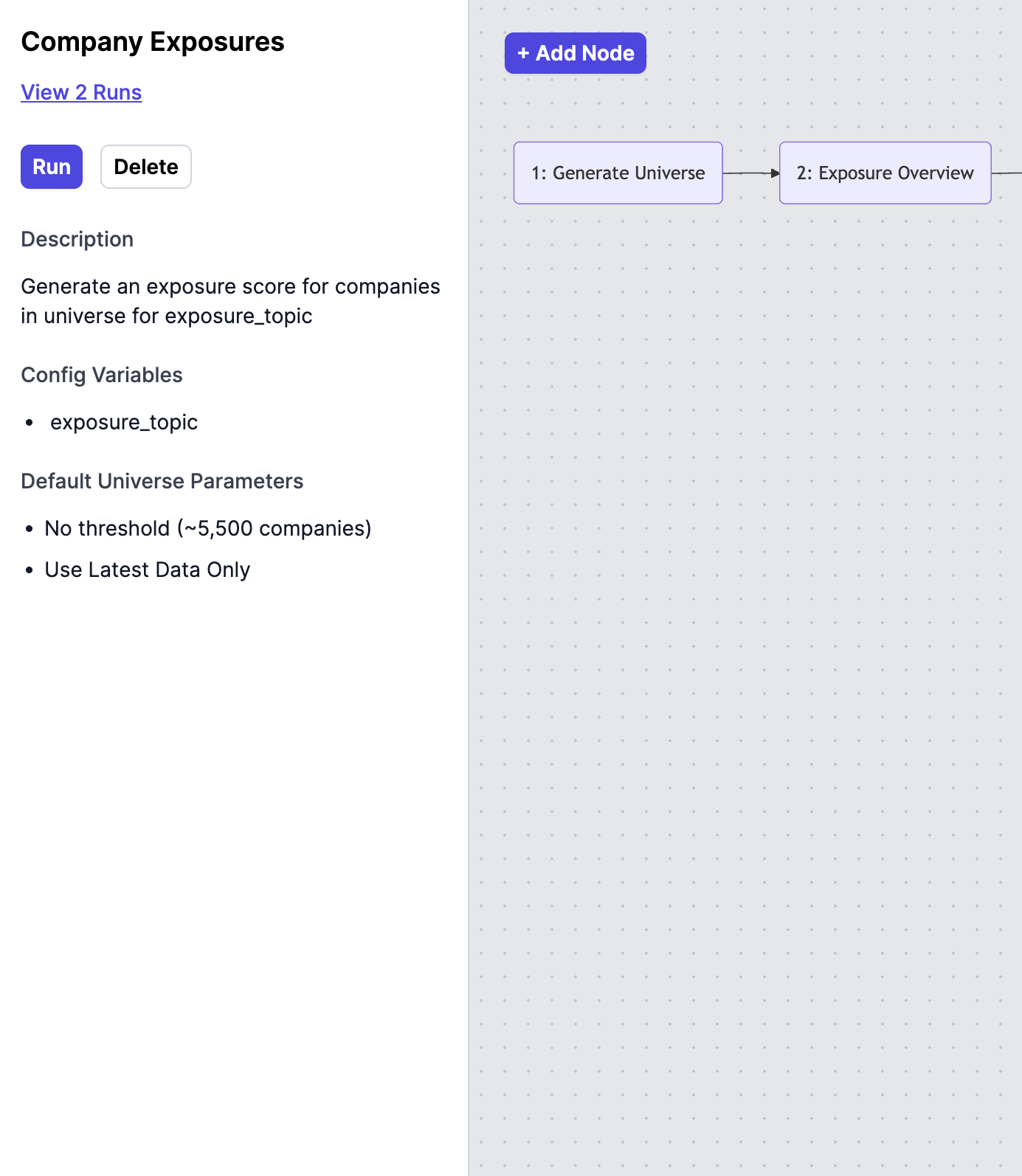

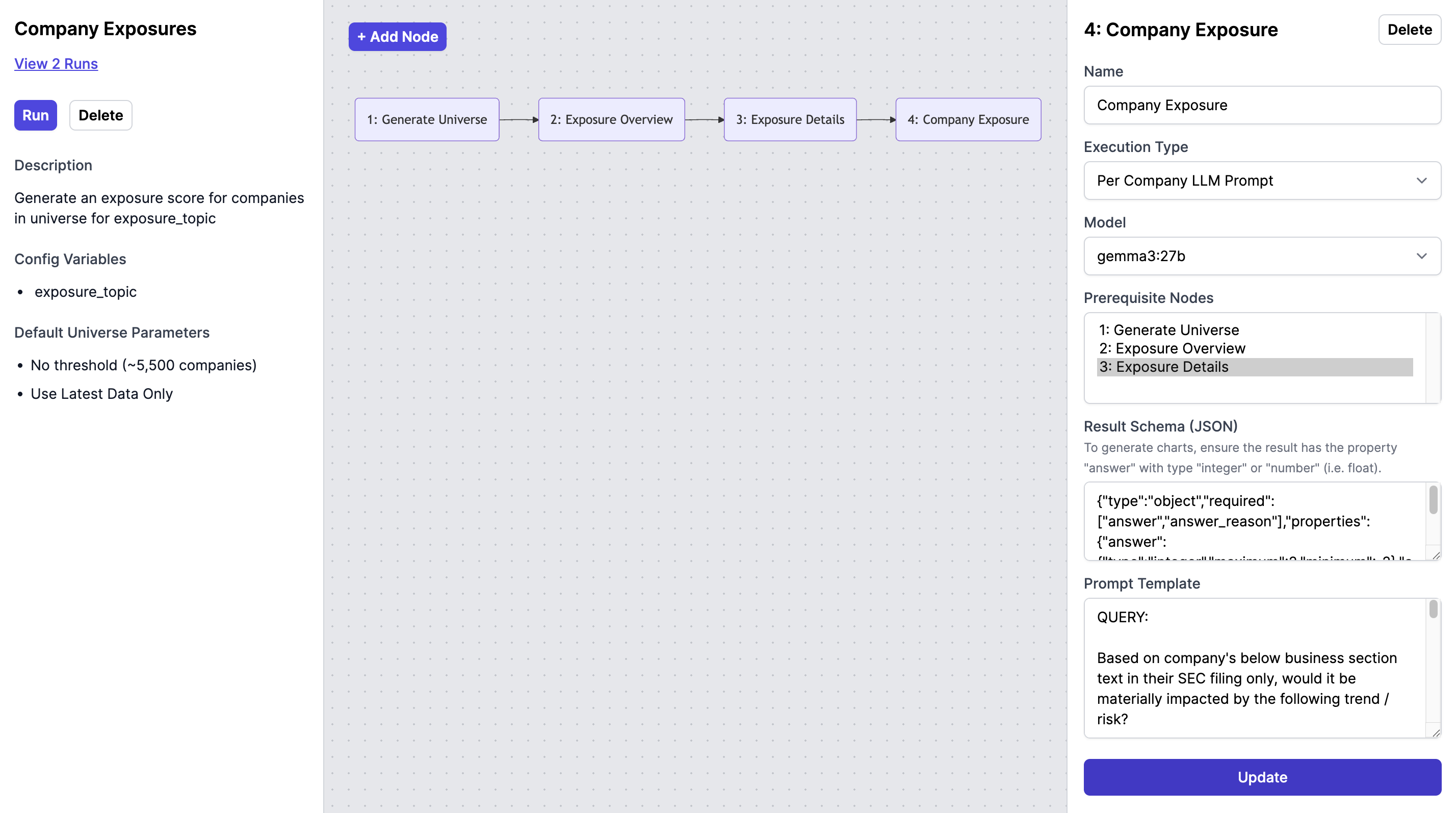

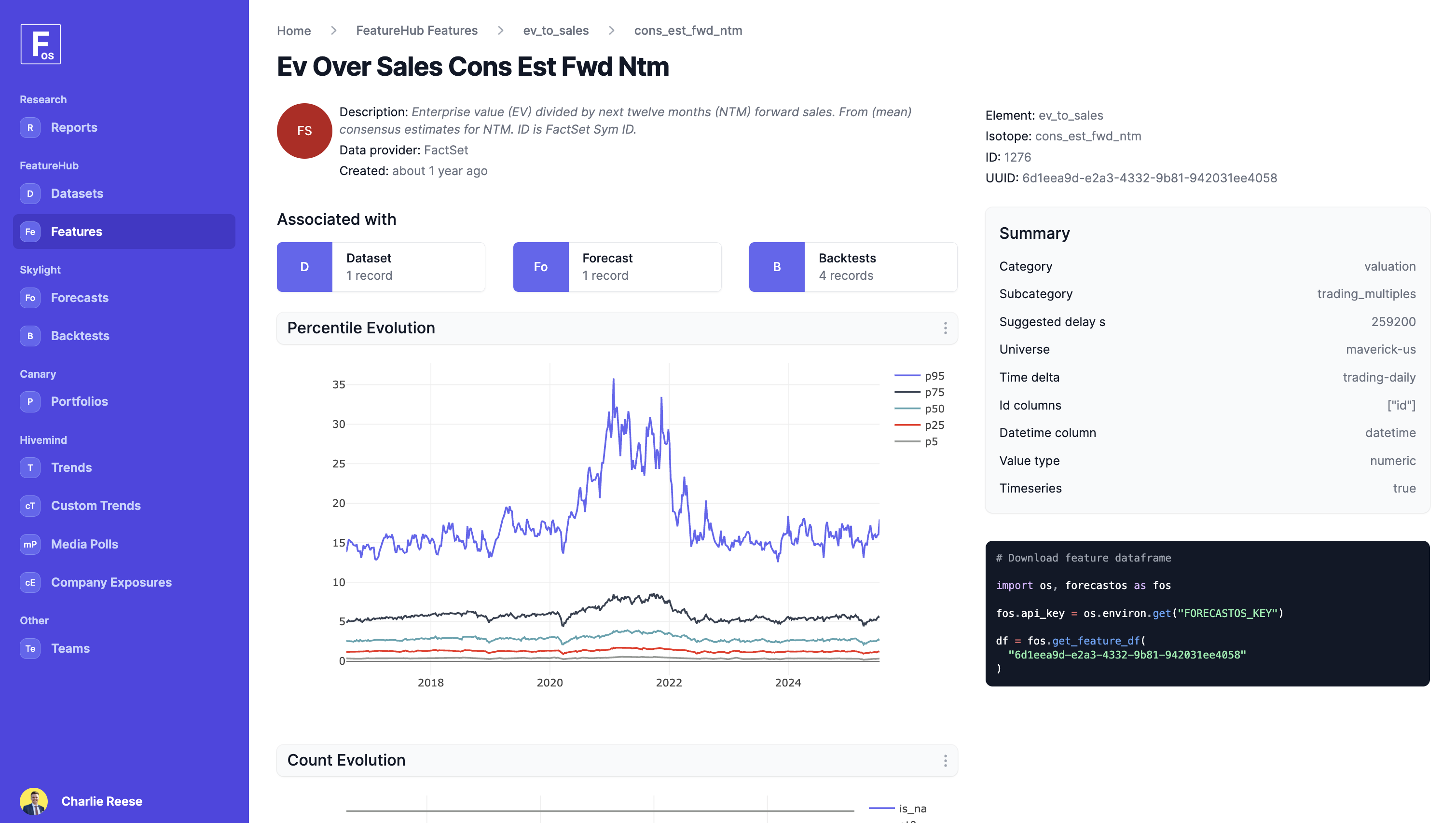

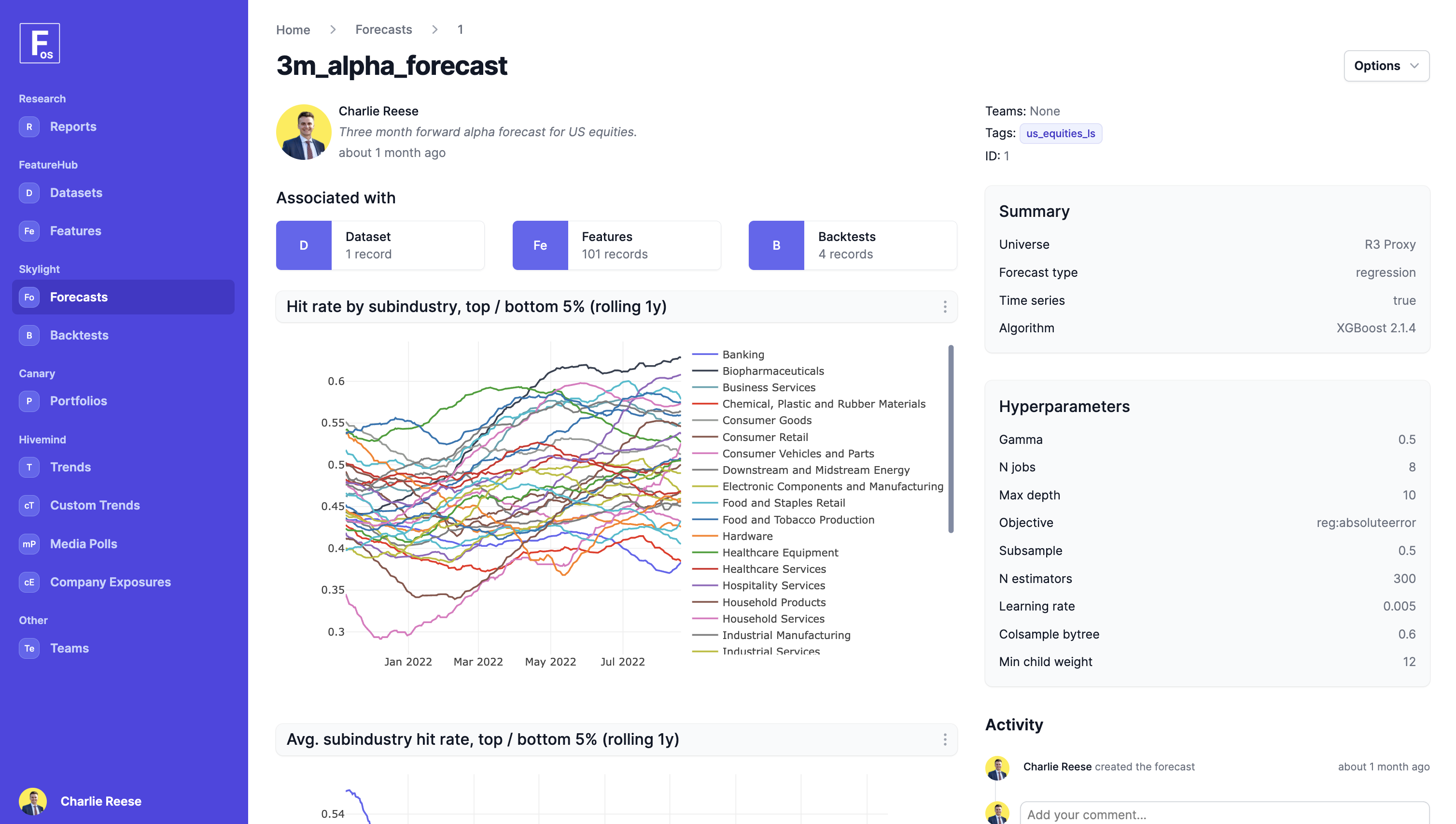

Hivemind is our trend identification and company exposure engine. It measures discussion to discover market relevant trends and scores trend impact, with direction and magnitude, for every company in your universe. All processes and outputs are customizable and point-in-time. Built for institutional quants.