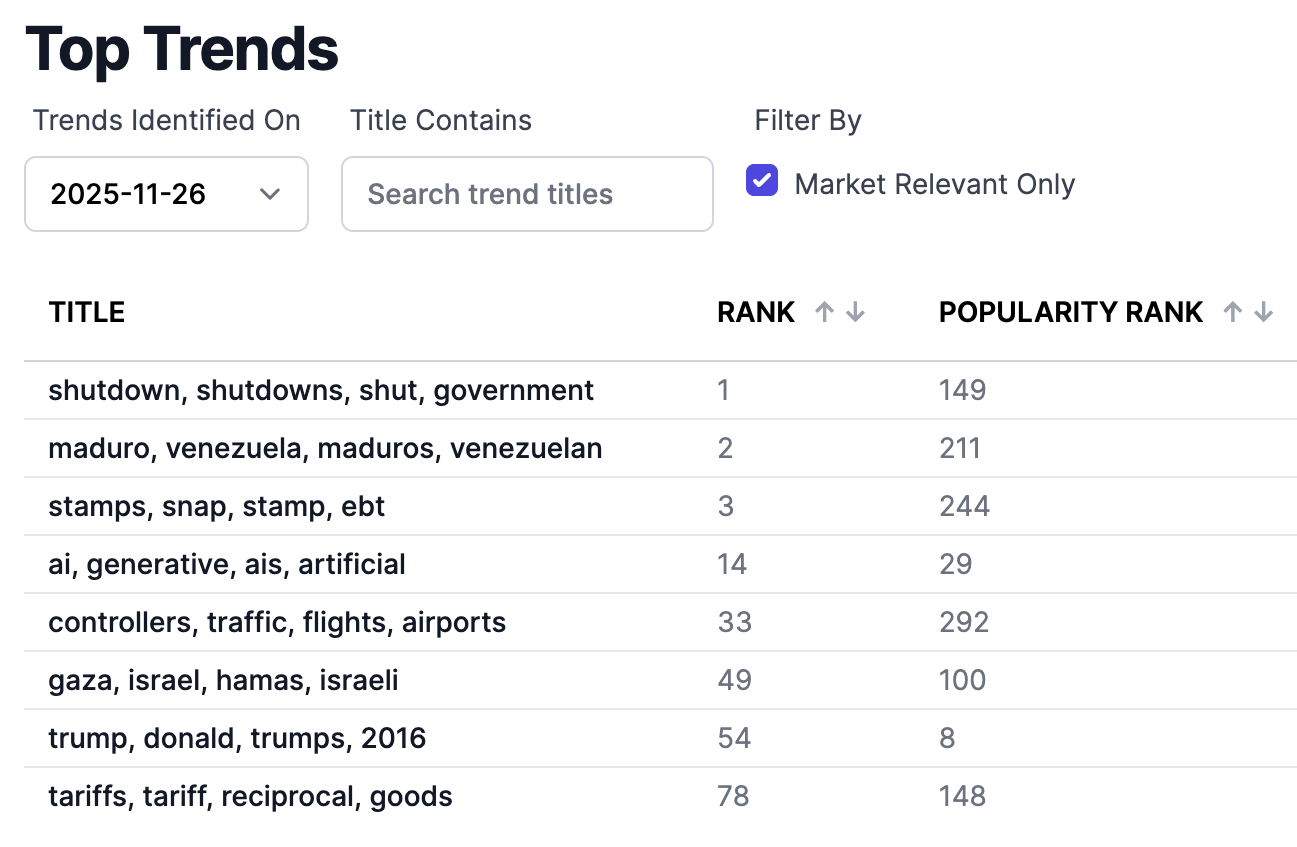

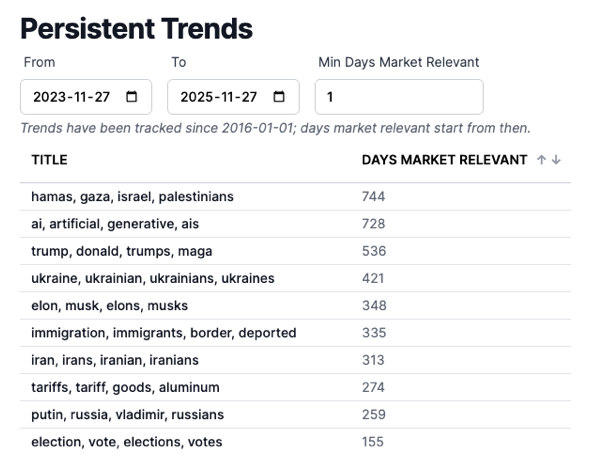

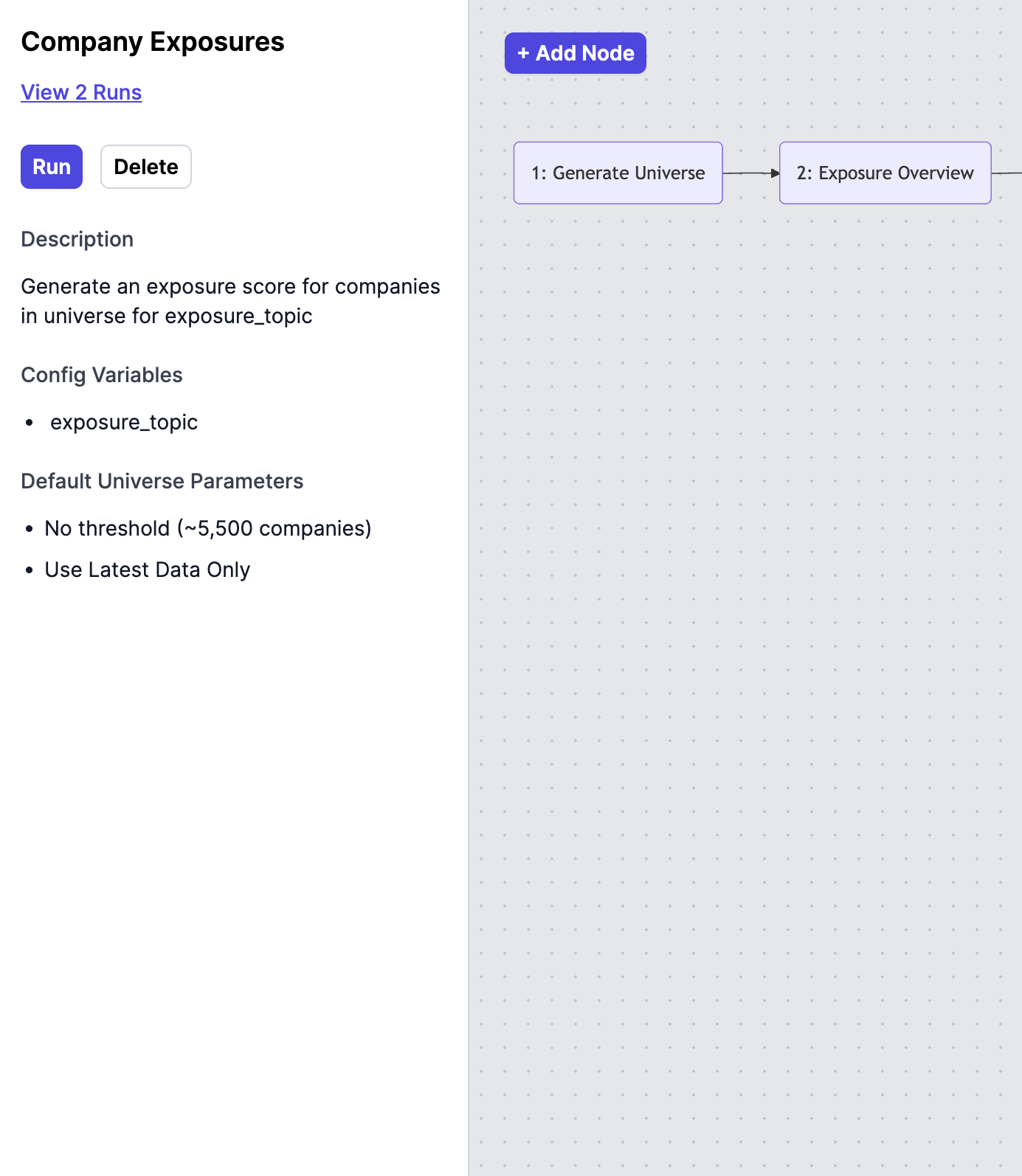

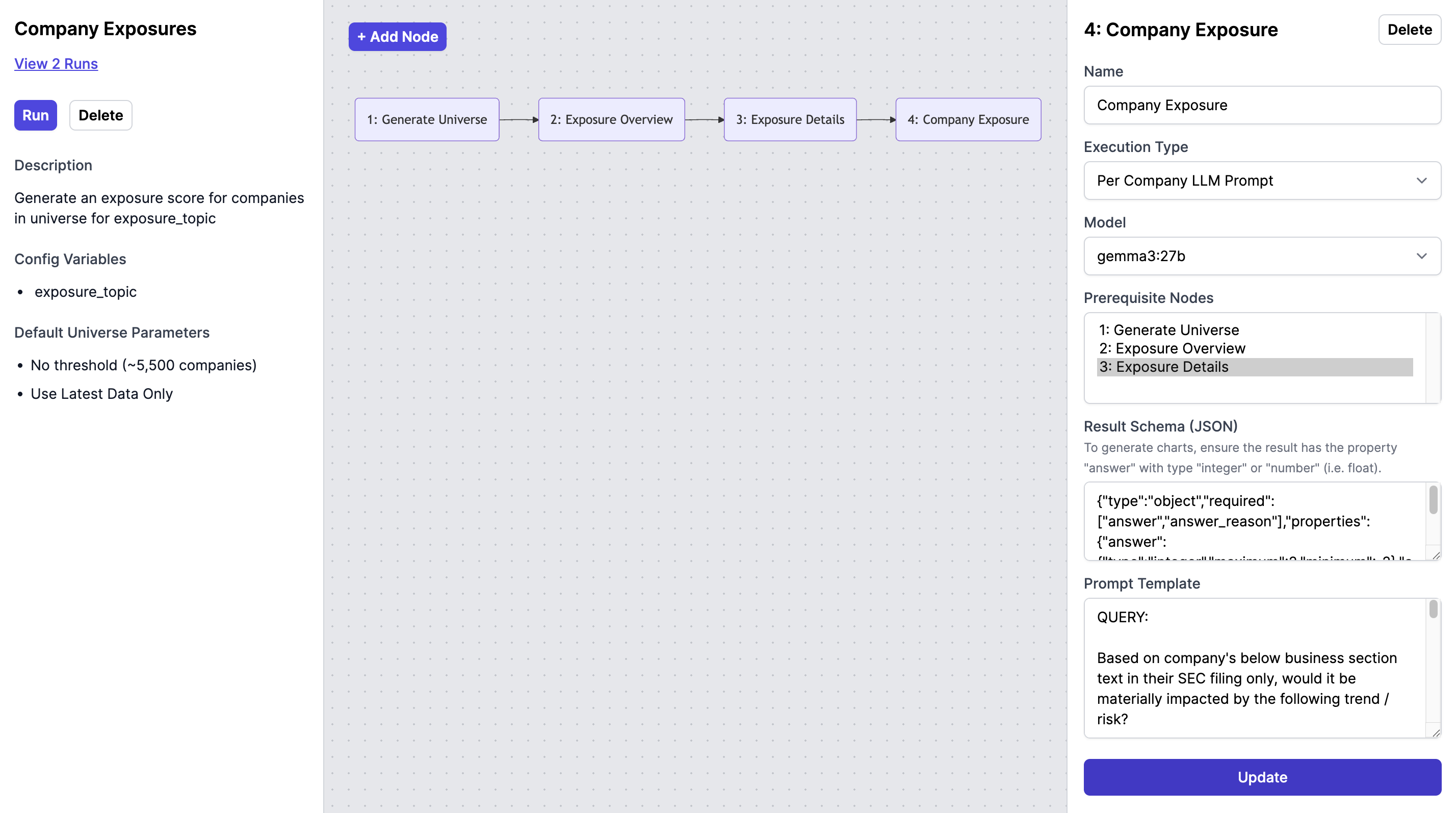

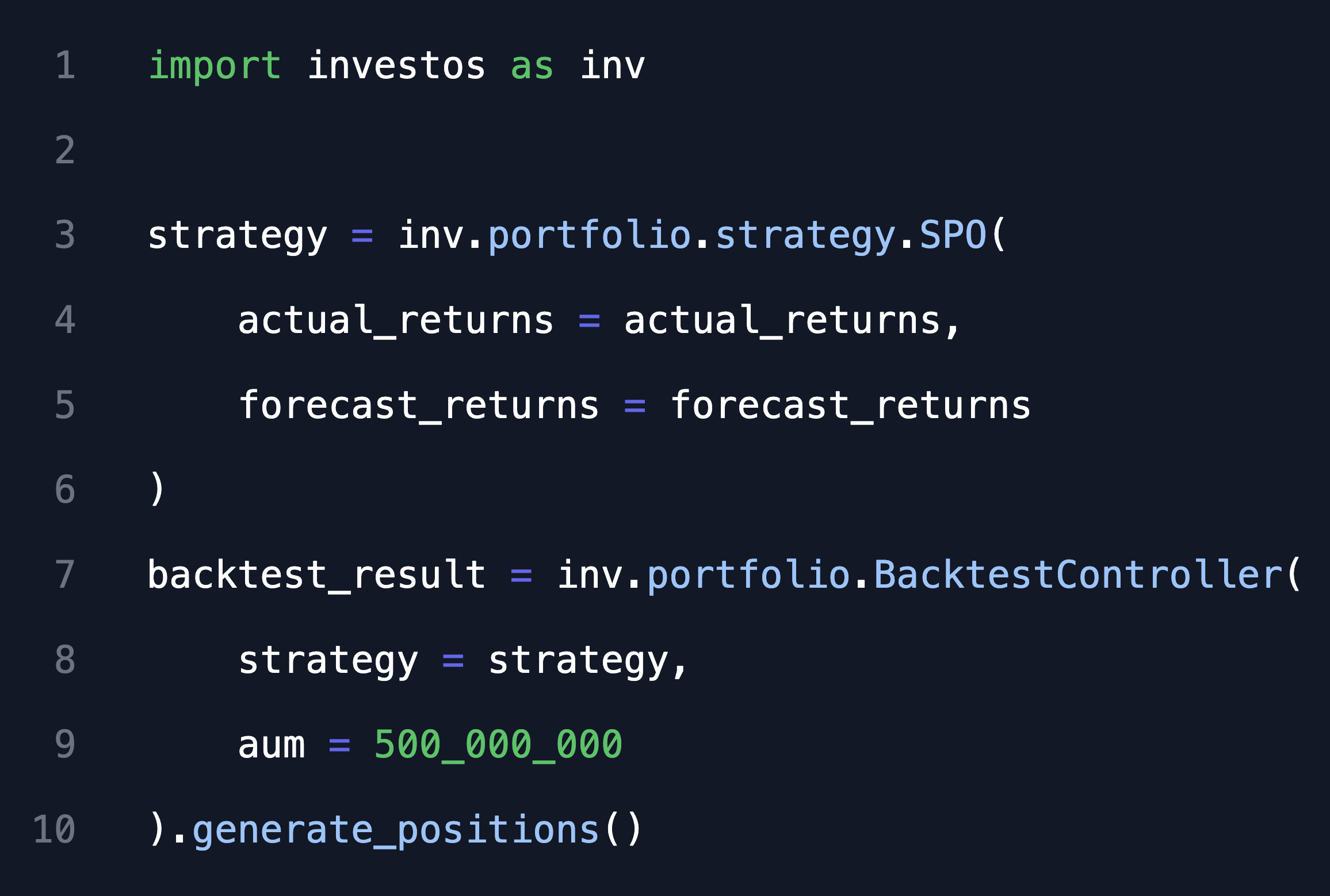

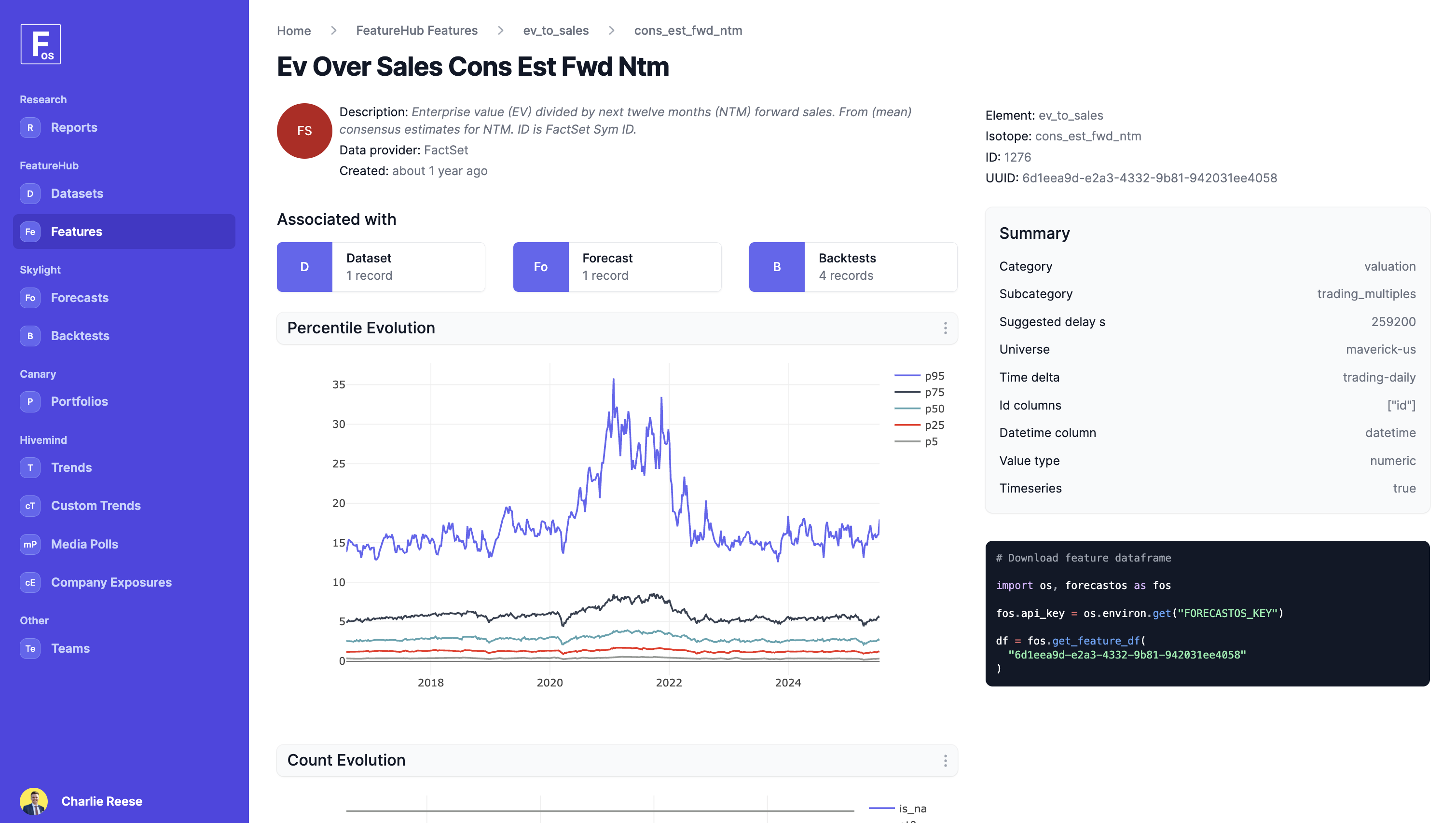

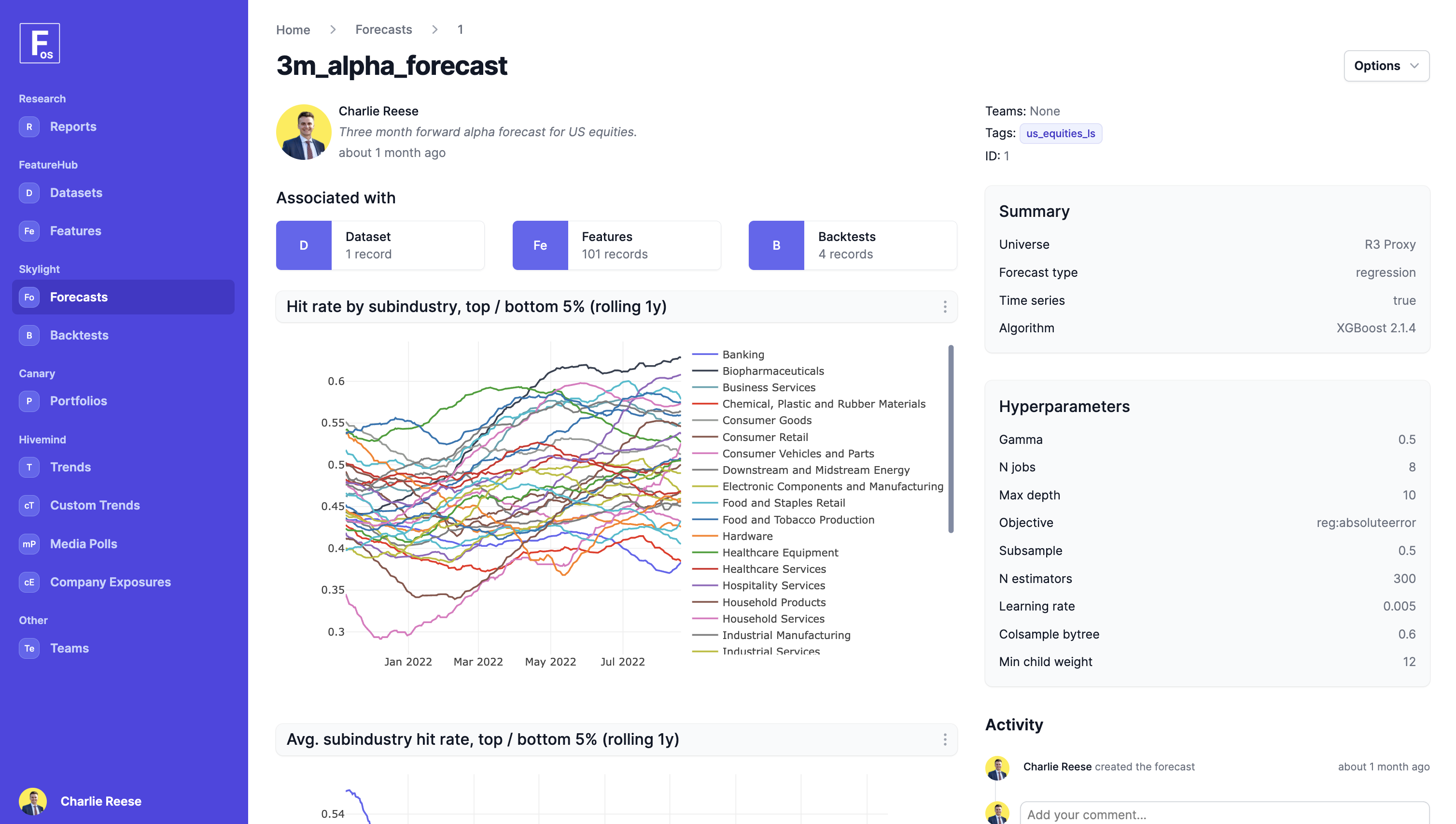

Traditional risk models remain necessary but are no longer sufficient. Market narratives and investor behavior now generate disruptive price dynamics that conventional frameworks weren't designed to capture. Tracking sell-side thematic baskets - often just a handful of names whose relationships are statistically unstable and decay quickly - provides little value for systematic managers trading thousands of instruments across multiple asset classes. Hivemind bridges this gap. By transforming complex unstructured and structured data into dynamic, point-in-time thematic exposures - calibrated with investor insight and updated systematically - it gives quantitative investors the tools to manage risks that legacy models simply can't see. This is the first real step toward next-generation risk control.